Tomorrow, our mobile phone will be screened by Buffett again!

At 22:15 Beijing time on May 4th, the annual shareholders’ meeting of Berkshire Hathaway will be held in Omaha, USA. It is estimated that about 30,000 shareholders will attend, and millions of people will watch it online. The most noteworthy issues of this shareholders’ meeting include:

Who is Buffett’s successor? — — Bashen is 88 years old and Munger is 95 years old.

What about Berkshire’s more than $110 billion in cash? — — Look at the company’s share price of $320,000. Do you still think Maotai is expensive?

The repurchase scale will be as high as $100 billion? — — There are not many good companies worth buying, so I have to buy myself.

However, for A-share investors, they may be more concerned about this question: What does Buffett think of the China market? Which stocks of A shares meet its stock selection criteria?

Which A shares can enter the eyes of the law?

There are many criteria for Buffett’s stock selection, but there are clear quantitative criteria. He only said one sentence, that is, the annual return on net assets (ROE) is greater than 20% for 10 consecutive years.

The so-called return on equity (ROE) is the ratio of company profits to shareholders’ equity. It represents the investment income of investors, in short, how much money the enterprise can earn for investors.

ROE is a measure of a company’s long-term profitability. The higher the ROE, the higher the net profit it earns with the same shareholder capital investment. According to Coca-Cola’s standard, that is, keeping the ROE above 20% for 10 consecutive years, it is the company that Buffett may like.

So, which companies in A shares meet Buffett’s standards?

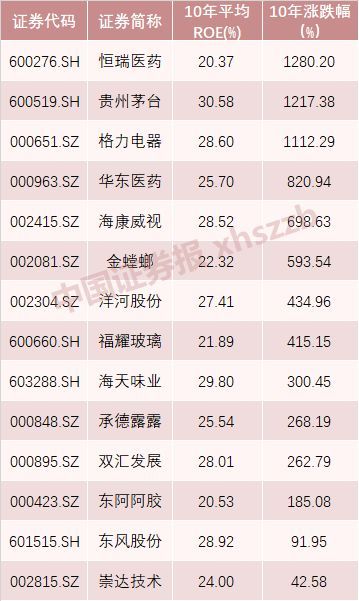

Wind data shows that in the 10 years from 2009 to 2019, among the listed companies whose ROE (deduction/dilution) continuously exceeds 20%, there are only five listed companies in A shares, namely Kweichow Moutai, Haitian Weiye, Gree Electric, Yanghe and Chengde Lulu.

The average share price increase of these five listed companies in the past 10 years is 690.49%, and the annualized rate of return is 22.97%. The biggest increase is Kweichow Moutai, which rose 12 times in 10 years, followed by Gree Electric, which rose more than 11 times in 10 years.

If we relax the ROE standard to 15%, that is, we will keep the ROE above 15% for 10 consecutive years. So, how many companies in A shares meet this standard?

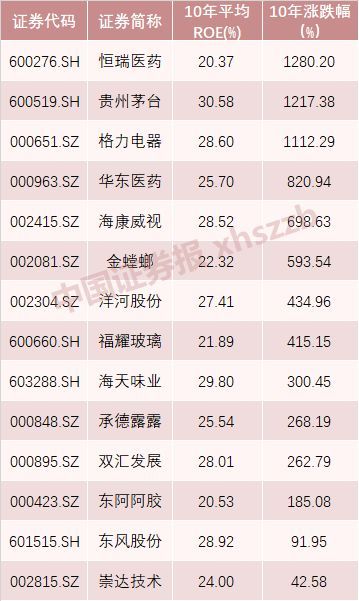

Wind data shows that in the 10 years from 2009 to 2019, there were 14 listed companies with ROE (deduction/dilution) exceeding 15% continuously, namely Shuanghui Development, Kweichow Moutai, Haitian Weiye, Hikvision, Gree Electric, Huadong Medicine, Yanghe, Chengde Lulu, Hengrui Pharma, Chongda Technology, dongfeng shares, Fuyao Glass and so on.

The average share price increase of these 14 listed companies in the past 10 years is 551.72%, and the annualized rate of return is 20.62%. Among them, Hengrui Pharma, Kweichow Moutai and Gree Electric rose more than 10 times, while Huadong Medicine, Hikvision and Golden Mantis rose more than 5 times.

Is Bashen’s strategy unacceptable?

In the past 10 years, what is the investment income of Warren Buffett?

According to media calculations, if an investor bought a dollar of Berkshire stock 10 years ago, the return today is about $2.4, but if this dollar is invested in the Standard & Poor’s 500 Index Fund, the return today is about $3.2. In other words, in the past 10 years, the income from investing in Berkshire has not been as high as that from investing in the S&P 500 index fund.

In 2018, the worst performance of global financial assets in the past 100 years, the "stock god" seems to be unhappy. Suffering from various "thunder" such as Apple’s performance falling short of expectations and Kraft Heinz’s performance changing face, Berkshire lost more than $25 billion in the fourth quarter of 2018, but still earned more than $4 billion in the whole year.

But in A-share market, Buffett’s stock picking strategy still seems feasible.

In the past decade, 108 A-share stocks have increased more than 5 times, and 29 have increased more than 10 times. The median ROE of these 29 stocks is 14.88%. During this period, the Shanghai Composite Index rose by 24.72%, the Shanghai and Shenzhen 300 Index rose by 50.2%, the CSI 500 Index rose by 74.59%, and the Shenzhen dividend index rose by 132.51%.

Obviously, those companies with long-term earning ability and dividend-paying ability can surpass the market if they buy at a reasonable price. However, it should be pointed out that value investment is by no means equal to an ROE index, and the stocks selected according to it are not necessarily suitable investment targets, but only help us find out those good companies more easily.

The above data illustrates two problems:

First, as Buffett said: "By investing in index funds regularly, an investor who knows nothing can usually beat most professional fund managers." Buffett has recommended index funds for more than ten times.

In Buffett’s view, the vast majority of investors rarely invest in index funds, and as a result, their performance in investing in stocks is mostly just mediocre, or even disastrous. There are three main reasons for the loss of investment stocks:

1. The cost is too high, investors buy and sell too frequently, or the expenses are too large;

2. Investment decisions are made according to gossip or market trends, rather than after careful consideration and quantitative analysis of listed companies;

3, blindly chasing up and down, buying or selling at the wrong time.

Second, practice has proved that the companies with the strongest earning power in A-shares can bring rich long-term returns to investors.

The overall growth level of A-share listed companies is better than the average level of social enterprises. The long-term stock price trend charts of leading enterprises such as Gree Electric, Vanke A, China Merchants Bank, China Ping An and Fuyao Glass are all consistent with the development path of enterprises.

The method of value investment has not failed in A-shares. In fact, A-shares will create a good opportunity for value investors to pick up bargains every few years, making it easier for investors to meet good prices. Numerous masters have emphasized that all investment is to find a good industry, a good company and a good price.

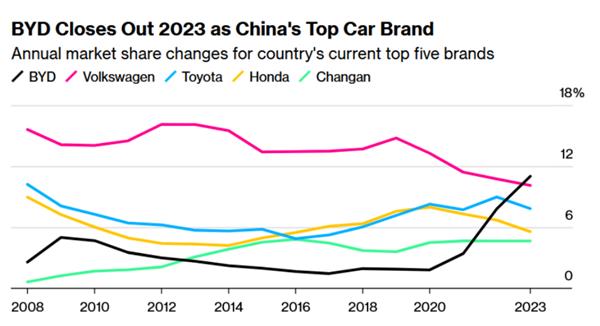

Finally, Buffett has bought two China stocks so far — — China Petroleum and BYD.

In 2003, Buffett bought H shares of China Petroleum at a price of HK$ 1.6, and cleared the position when the share price reached HK$ 13.5 in 2007, with a four-year income of more than 7 times (the reinstatement factor has been considered, the same below). When Buffett bought it, the P/E ratio of China Petroleum was only 5 times, while when China Petroleum was listed on A-share in 2007, the P/E ratio of 48 yuan’s opening price was as high as 63 times.

In 2008, Buffett subscribed for 225 million shares of BYD at a price of about HK$ 8 per share. At present, Buffett still holds shares in BYD, and its latest share price is HK$ 53.55, and its income has exceeded five times. When Buffett bought BYD shares, the corresponding P/E ratio was only 10.2 times. At present, its latest P/E ratio is 39.29 times.

China securities journal Song Zhaoqing