618 Blood Guide: Pick up the beauty that makes you chop your hands and protect the track.

"Beauty" has always been a potential need of all people, and "Yan value is justice" expresses people’s pursuit of beauty. As the main contribution to the sales of the shopping festival and the key category of live e-commerce, the beauty care track has experienced rapid growth in recent years. In this paper, the personal care industry of beauty is analyzed, and its development status and future are discussed in depth to share with you.

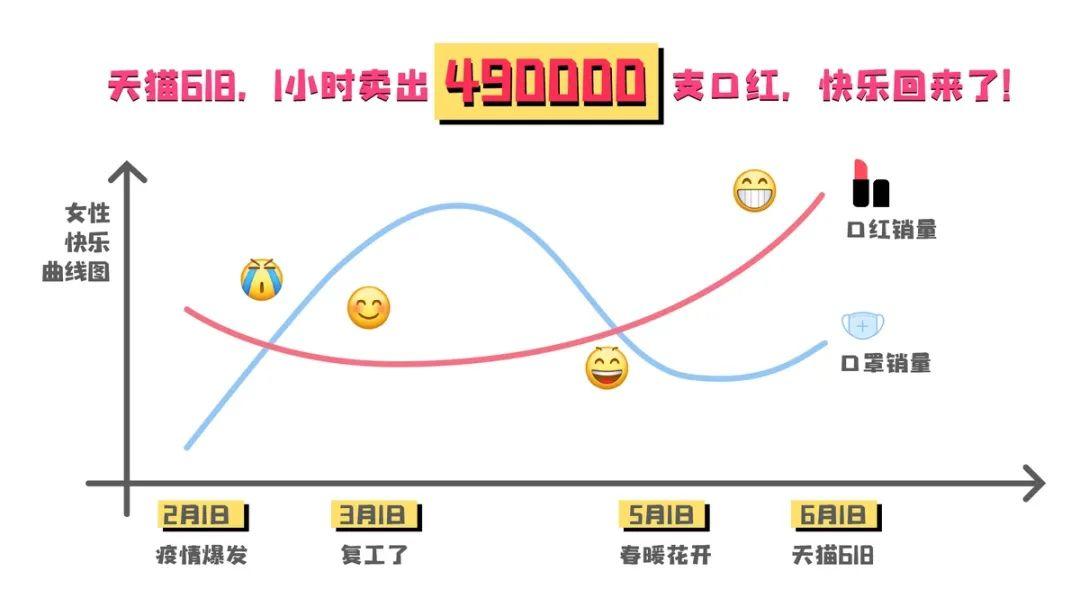

The demand for beauty has ushered in a concentrated outbreak in 618.

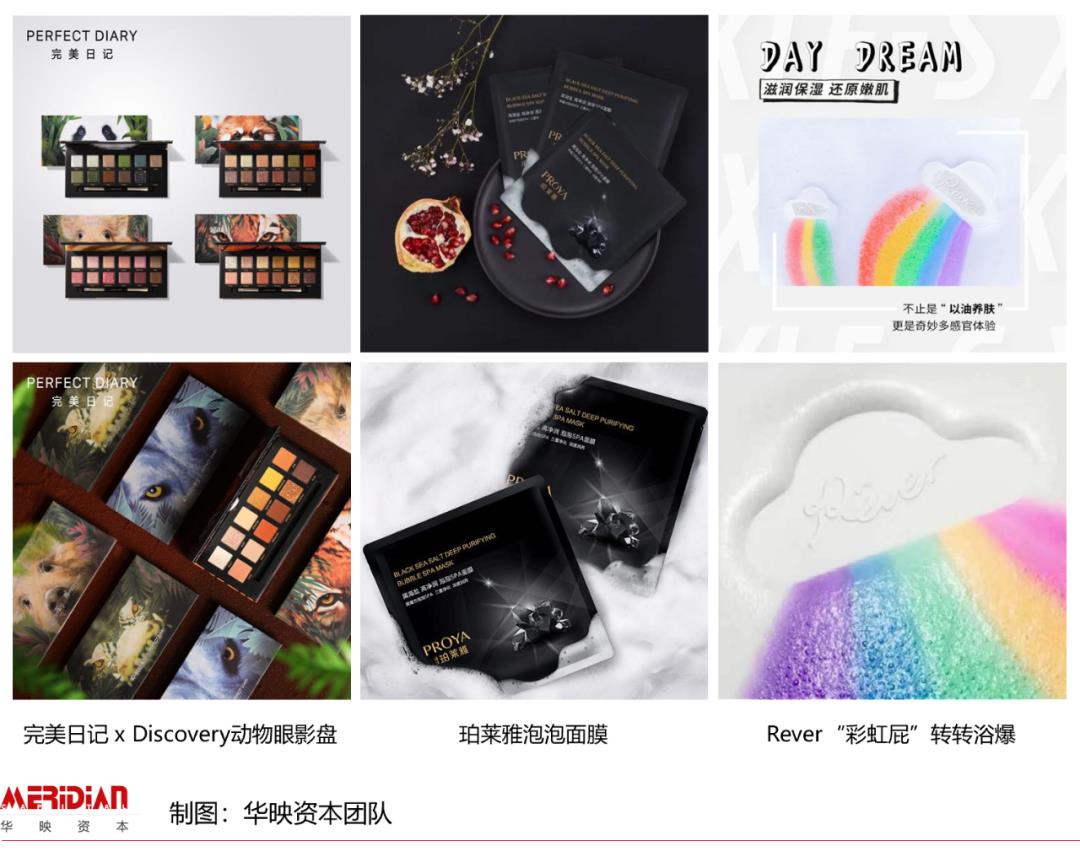

Just 59 seconds after 0: 00 on Tmall 618, beauty sales broke through 100 million, and personal care broke through 100 million in the third minute, surpassing last year’s full-day sales. Among them, the performance of domestic brands is eye-catching: Perfect Diary put on makeup Top1, and the sales of Red Earth, Meijiajing and herborist exceeded the whole day of last year in 10 seconds, 17 minutes and 50 minutes respectively.

In the early morning report of 618 released by JD.COM, the total amount of orders placed during the 6.1-6.18 shopping festival reached 269.2 billion yuan, setting a new record, and beauty and skin care once again ranked among the TOP3 categories with the largest number of consumers.

Also this month, Liren Lizhuang IPO successfully held a meeting, and if Yuchen followed closely, the beauty agency operation company gained high attention in the capital market.

A beauty protection track that occupies the TOP position in FMCG and outperforms the market under the epidemic.How far has it come? What other opportunities are there? What kind of company is "worth buying"? This issue of "Hua Ying Insight" will be interpreted one by one and discussed with you.

As the main contribution to the sales of the shopping festival and the key category of live e-commerce, the beauty care track has experienced rapid growth in recent years, and many high-quality targets have emerged. Macroscopically, the "three highs" characteristics of the beauty care market-high potential, high flexibility and high dispersion-all bring time and space to young companies. In-depth observation of the track, we also see the rapid changes in the industry, new trends emerge one after another, and many new brands, service providers and other high-quality standards are emerging.

According to Euromonitor Euromonitor data, China is already the second largest cosmetics market in the world, accounting for about 1/5 of the total global market, and its annual growth rate far exceeds that of the United States, Japan and South Korea; At the same time, the per capita consumption is only about 1/6 of the above three.The demand potential is far from being fully released.

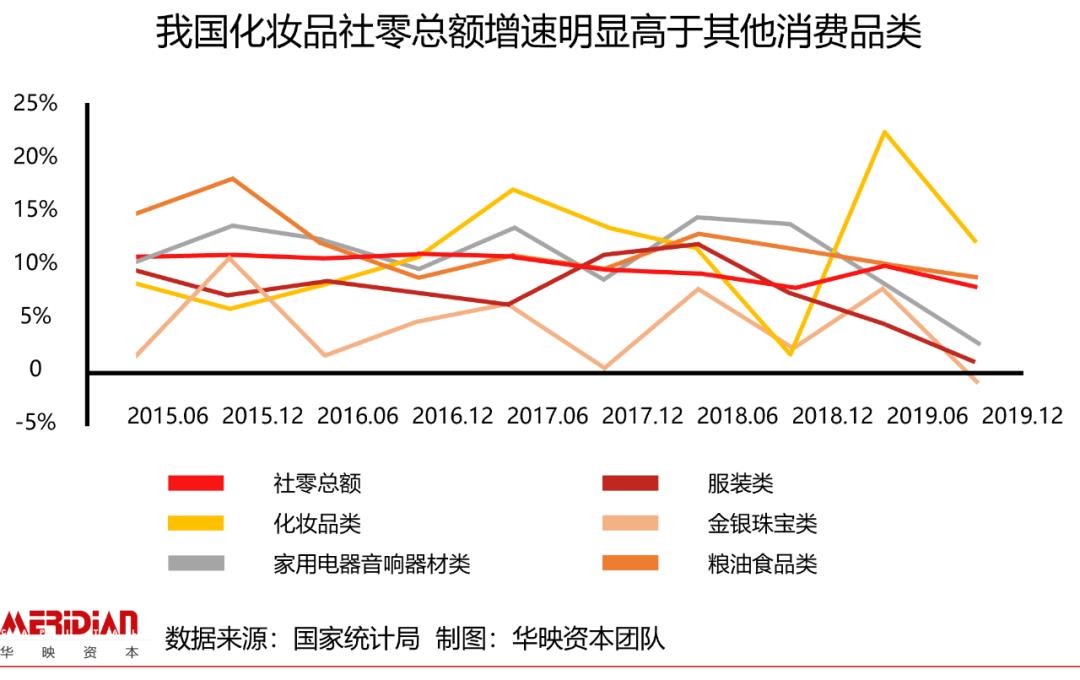

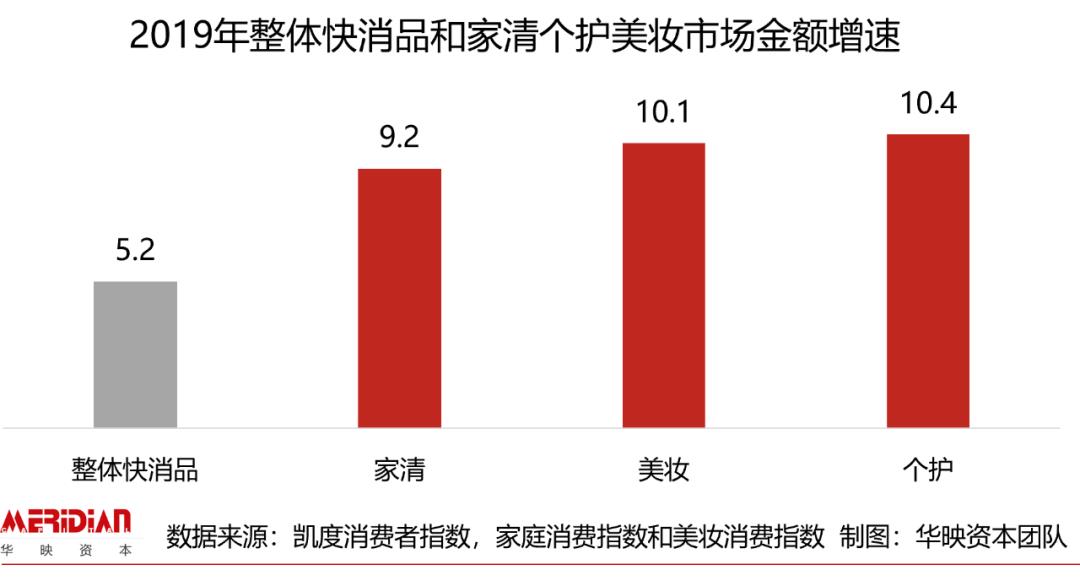

The strong growth of beauty care is accelerating. China’s cosmetics agencies have maintained a long-term double-digit growth in total amount.Obviously higher than the overall growth rate of social zero and the growth rate of other optional consumer goods.In 2019, the growth rate of beauty, personal care and household cleaning products led the overall FMCG market.

In the post-epidemic era, beauty care has becomeThe epidemic was relatively unaffected and recovered quickly.One of the categories.

In May, the total retail sales of consumer goods in China was 3,197.3 billion yuan, a decrease of 4.7 percentage points over the previous month. From January to May, the total amount of social zero declined year-on-year, but gradually improved. Among them, cosmetics have become one of the few categories that have achieved growth. In May, the total retail sales of cosmetics reached 27 billion yuan, a year-on-year increase of 12.9%.

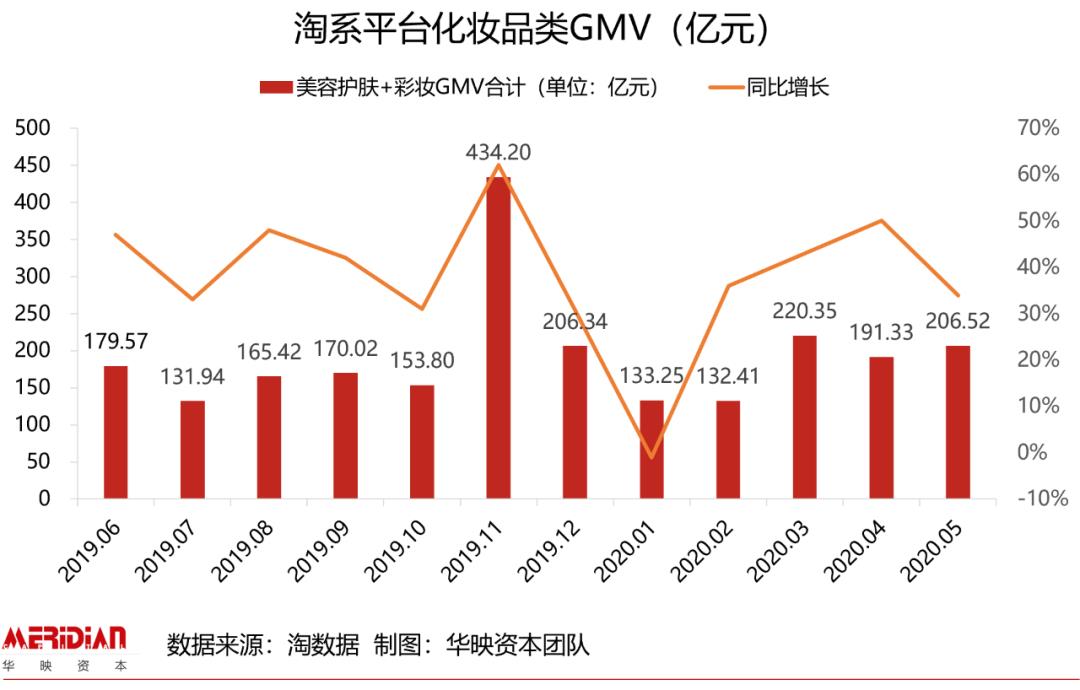

In May 2020, the total turnover of cosmetics (beauty and skin care+make-up) on Taobao platform was 20.652 billion yuan, a year-on-year increase of 33.95%. With the recovery of offline passenger flow and the promotion of new online retail model, the consumption boom of cosmetics has improved.

Generally speaking, although the sales volume of the beauty track has decreased and the growth rate has slowed down under the influence of the epidemic, compared with other categories, the growth attributes and growth rate of the track itself are still higher than that of clothing, home appliances, food and jewelry.

Of course, in terms of breakdown, the impact of the epidemic on the beauty care tracks is different.Local uneven heat and coldCare needs such as skin care and family cleansing are released with ample home time and improved health awareness, while demands such as make-up are temporarily sealed by masks of different thicknesses together with facial values.

The pattern of China’s cosmetics industry is relatively scattered. Affected by factors such as the late start of the industry, rapid development and complex consumer groups, as of 2018, China’s cosmetics market CR10 (the top 10 share concentration of the industry) was only 39%, compared with South Korea (67%) and the United States (61%).The industry concentration is low and the long tail effect is remarkable, which brings time and space for new brands.And compared with the high-end market, the mass market where new domestic brands mainly gather is more dispersed.

With the continuous subdivision of user needs and usage scenarios, the product categories of beauty and skin care are becoming more and more refined, which also brings new opportunities to the industry. Take make-up, for example. Although international brands are still standing in the big categories (makeup, lipstick, etc.),However, in recent years, emerging brands have gradually occupied a place in some sub-categories.

After 90/95, it has become the main consumer who can buy more, shop more and adopt early adopters. The time-honored domestic brands such as Baiqueling have become younger, and the cutting-edge domestic brands such as Huaxizi, HFP and Perfect Diary have frequently experienced new explosions. Beauty care has become the second largest category of online live broadcast with fire after food …In recent years, the innovation and change of beauty care industry has been particularly active."New products" and "new markets" deserve attention.

A list of the characteristics of generation Z in the cleaning and consumption of beauty personal care: generation Z has become an opportunity group with fast growth and high UV value. In the process of attracting new customers, it is worth making more efforts to make a key breakthrough for this group.

Open the little red book and brush it with your hand. Nowadays, more and more complicated and meticulous skin care steps and makeup processes make people "open the door to the new world" in minutes. In recent years, there are frequent new products and explosions in the beauty care track, and the product forms and functions are constantly innovating.

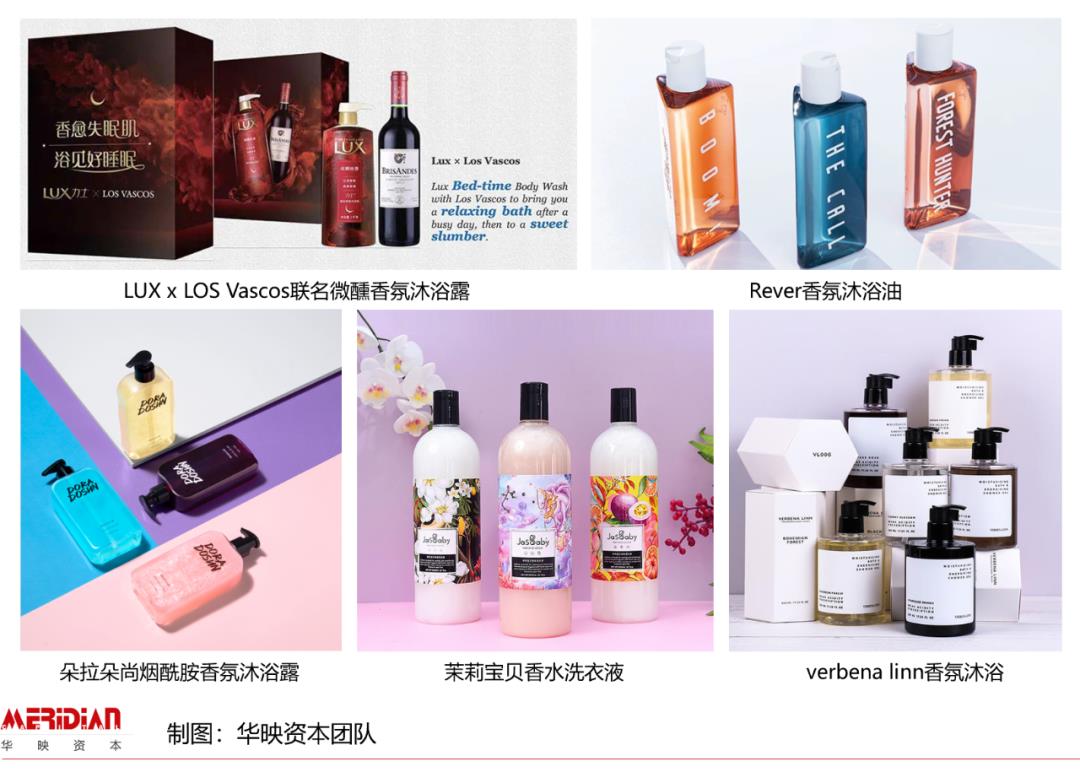

Beauty no longer only needs to be displayed to the outside world, but also the process should be pleasant and moving. More and more consumers are beginning to pay attention to the exquisiteness of the whole body and the healing time of self-reward.The annual sales of Ali’s body care/body cleaning category is about 17.5 billion yuan, and the body care market is "expanding". The current bedtime scenes account for as much as 44% of the total skin care scenes. It can be said that if you occupy the bathroom and bedroom, you will occupy a protective highland.

Paying attention to pleasing oneself also brings the fiery concept of fragrance. In the category of body care, many brands are using fragrance elements to add memory points to their products. In the category of cleaning care at home, the fragrance element has also become an important means for new players to break through the traditional monopoly, such as Jasmine Baby’s perfume laundry detergent, which helps the brand premium increase.

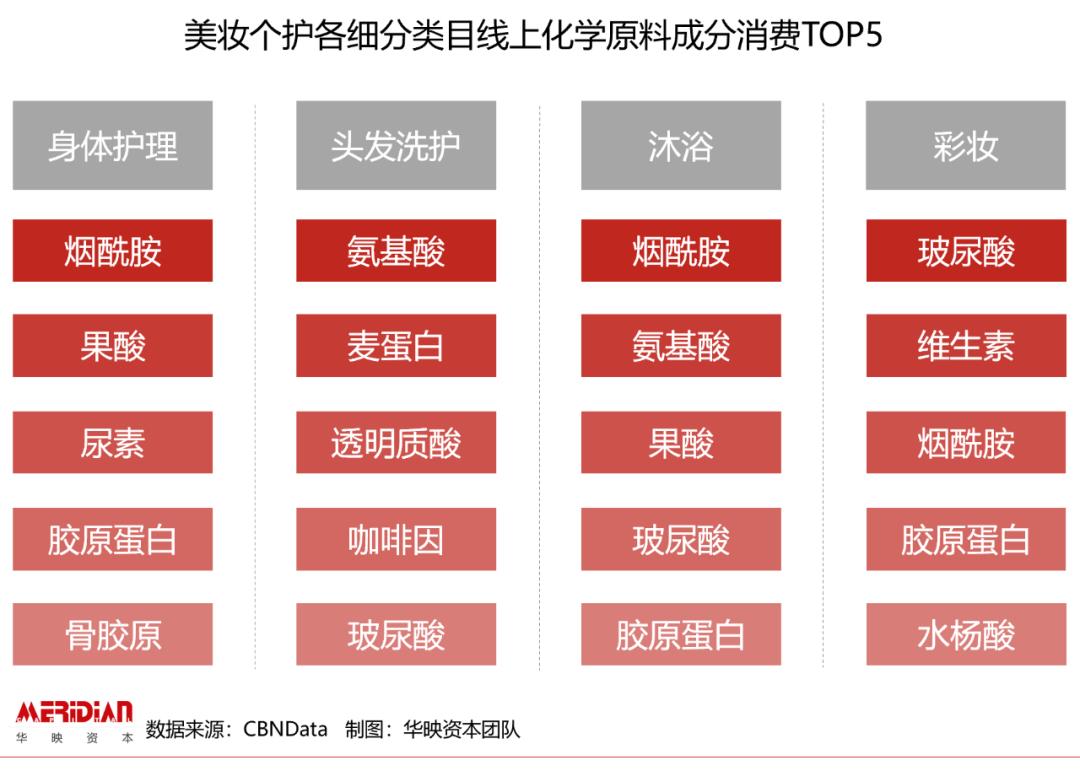

Different from the traditional big brands favored by consumers such as silver-haired people and post-80s generation,The beauty care market led by the post-90/95 era is personalized as a whole.Willing to spend time studying the ingredients, efficacy and active ingredients of products, so as to improve the demand for fine care. Led by whitening nicotinamide, all kinds of characteristic components are loved by the "component party" in all categories. For example, in body care, fruit acids are used to remove acne, and in bathing and hair care, amino acids are used to clean and resist damage.

Anti-aging, anti-acne, whitening … In the final analysis, function is the core foothold of product differentiation. Whether it’s the mechanical mask and the cosmeceutical products specially designed for acne muscles, or the rapidly developing new oral beauty industry, behind their great popularity, consumers’ demands for "functionality" and "professionalism" of products are reflected.

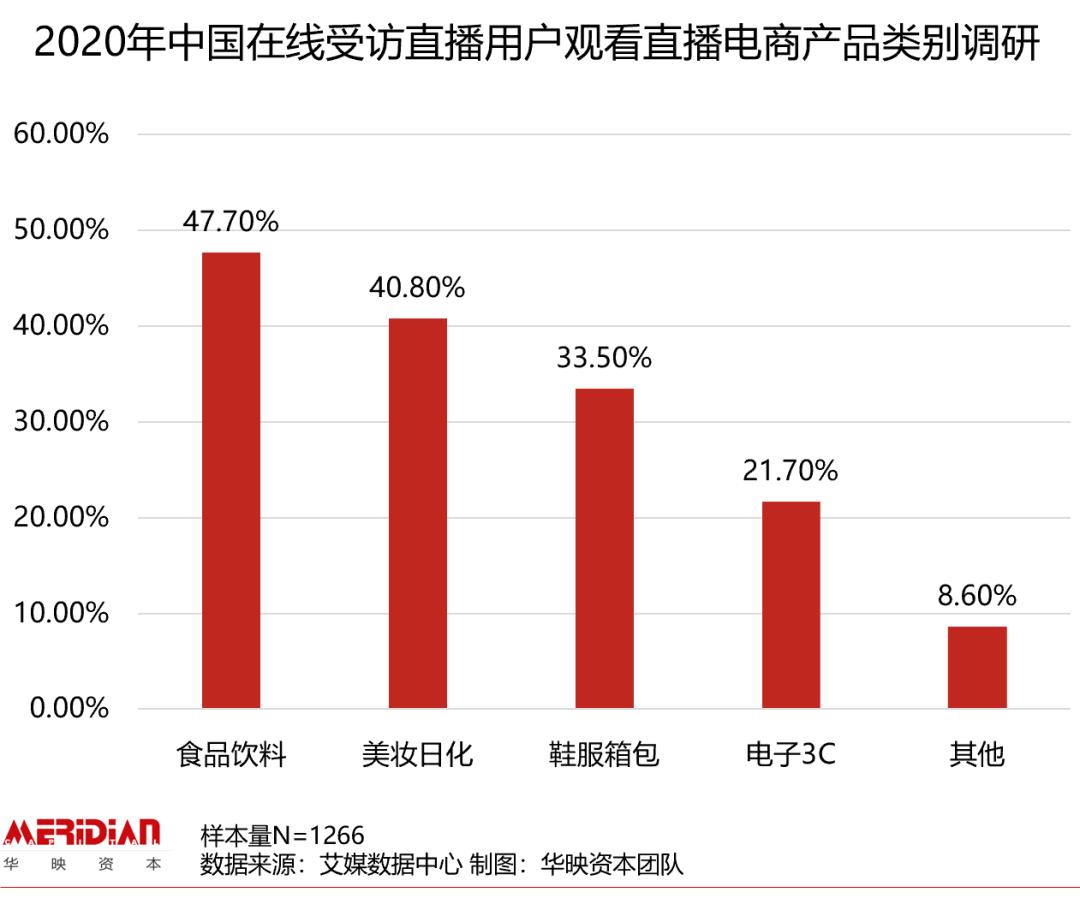

User attention transfer, e-commerce content and content e-commerce have brought new ways of planting grass and traffic conversion. In 2019, the GMV of Taobao live broadcast broke 250 billion, and platforms such as Pinduoduo and JD.COM entered the game one after another. 2020 is a well-deserved year of live broadcast.

From the lipstick color test in Li Jiaqi, to the women in Viya buying out big brands of skin care and beauty instruments, to the appearance of shampoo and sunscreen spray in the live broadcast room in Luo Yonghao,Beauty care has always been the second largest category in live broadcast after food and beverage.

New online channels such as "live broadcast with goods" make up for the impact of offline store closure, and live broadcast accelerates penetration in the epidemic. Alibaba’s latest quarterly financial report pointed out that more than half of Tmall merchants use Taobao live broadcast to bring goods, which is much more efficient than traditional offline counter promotion.

At the same time,KA, department stores and CS channelsAlso embrace online when the vacancy rate, store opening rate and passenger flow are not ideal, such as the transformation of offline stores in Polaiya and the establishment of online stores; Lin Qingxuan tried to open up the interests of e-commerce, WeChat applet malls and department stores, and opened up store warehouses and e-commerce warehouses as well as online and offline members; Shiran-CHO will focus on its own APP-CHO League and Tmall flagship store, and offline store service members will deliver goods to your door.

In addition to live broadcast, Beauty Personal Care, as a major consumer of FMCG, faces algorithm-driven platforms such as Tik Tok and Xiaohongshu, and traffic-driven platforms such as bilibili and Weibo.The logic and center of gravity are different.

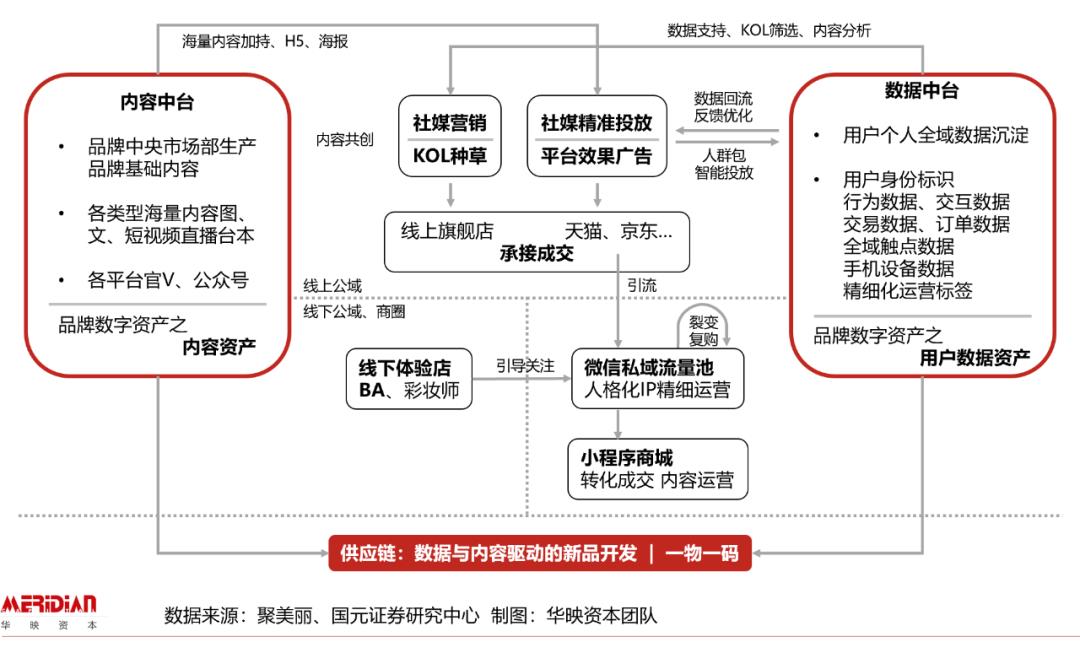

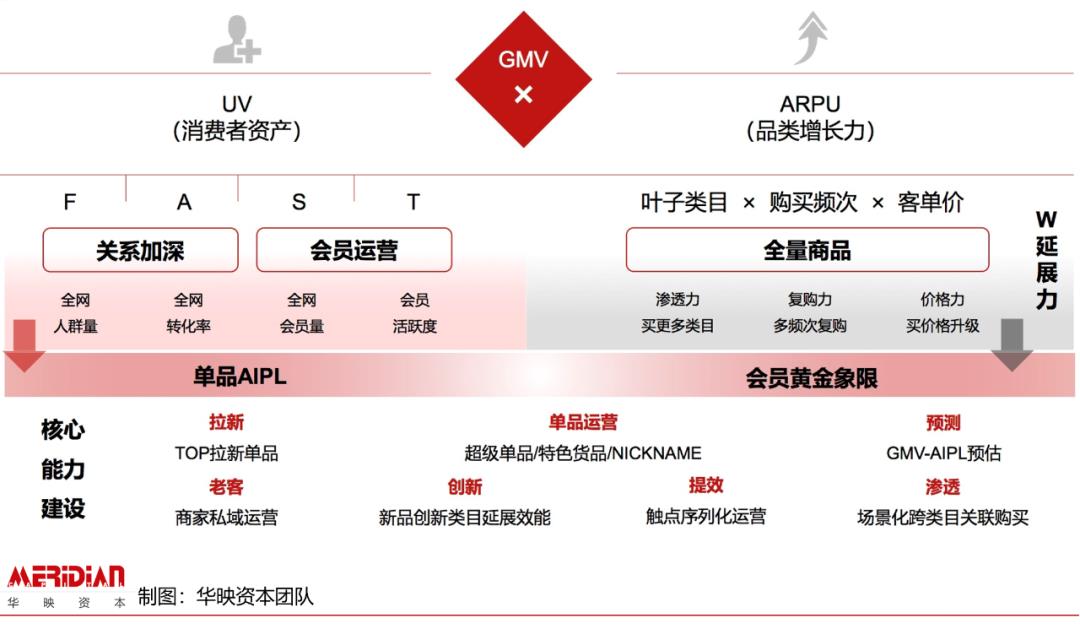

The traffic dividend peaked and the competition for user duration intensified, which prompted the traffic operation to enter the stage of refined operation from extensive growth. Social e-commerce introduces traffic to various platform stores through online mass delivery, social networks and kol grass planting, or offline BA traffic, which is further transformed into private domain and precipitated through small programs. Through the continuous revitalization of content and data, the brand is finally precipitated into digital assets.For the beauty protection track with perceptual purchase decision and high trust barrier,Private domain operation and heavy service are particularly important at present.

Since 20 years ago, a total of 25 companies in the field of beauty cosmetics and personal care in the primary market have obtained financing.Cosmetics and skin care productsIt is still a hot field, with three and five companies receiving financing respectively.oral cavityThe track has also attracted increasing attention, and a total of four companies have won the bid.

New hot areas includeMale health and beautyAccording to the published data, Cosmetic Contact Lenses projects are mostly concentrated in the vertical e-commerce platform & offline chain brands. In terms of stage, there are many early projects, and most of the projects won are concentrated in the stage of angel’s turn to round A; In addition, a few projects have entered the stage of strategic financing and M&A, such as Perfect Diary’s acquisition of Odin, a cutting-edge beauty brand.

On the other hand, many of the cutting-edge brands that rely on big trees to enjoy the cool air and have performed brilliantly in efficacy in the past two years areSub-brands launched by large companies with R&D strength. Like Yuze in shanghai jahwa, Medrepair and Runbaiyan in Huaxi Bio, and Renhe Pharmaceutical’s drug capital Renhe. Traditional industry giants have perfect technical equipment, sufficient R&D marketing budget and mature business matrix layout, so it is easier to strike a balance between sales growth, marketing and R&D.

In addition to accelerating the development of new products and the speed of new products, the head players have also achieved the extension expansion of the brand through continuous acquisition.For example, Johnson & Johnson completed the acquisition of Ci:z Holdings (the parent company of Chengye Doctor, a cosmeceutical brand); L ‘Oré al acquired perfume brands Mugler and Azzaro; from Clarins; And Unilever, L ‘Oreal, Estee Lauder and Shiseido bid for British cosmetic brand Charlotte Tilbury. In addition, there are also large-scale transactions from institutions. For example, KKR acquired a 60% stake in a professional beauty and hairdressing brand owned by beauty group Coty for $4.3 billion last week.

Overall, the acquisition of beauty giants presents the following characteristics:

- Pay attention to personalized trend brands: these brands are full of personality and are widely concerned by young people on social networks;

- The acquisition is more targeted: consolidating the company’s own strength in some fields as a supplement to the group’s product line;

- Brands with professional background have become popular for acquisition: such as cosmeceuticals, nature, scientific nursing, medical beauty and other keywords;

- Pay attention to the brand with unique products and bright growth.

In addition to the "half of the country" occupied by traditional giants, the choice of categories is very important for new players, and the difficulty of entering different segments of the track is different. We will also continue to pay attention to the following three types of opportunities:

- Potential star track: represented by Cosmetic Contact Lenses, oral beauty, etc.Because there are no powerful giants in these fields, and the fields are small but the growth rate is fast, new players still have the possibility of being small and broad. The development of this field is consistent with the demand growth of new people. Both Cosmetic Contact Lenses and Oral Beauty have certain medical attributes, and both have certain qualification requirements in product production and channel sales. Compared with cosmetics, the entry threshold for skin care is relatively high.

- Breakthrough growth track: represented by Jiaqing, CS channel and individual small household appliances.Although there are strong head players in this field, the self-innovation speed of head players is lower than the development speed of the industry, leaving a certain development time and space for new players; For CS channel, upgrading the product structure and optimizing the user experience are the keys for new players to break the game. For small household appliances, the resource scheduling and quick response ability at the supply chain end are the key to its failure; For Jia Qing, category innovation is the key to its breakthrough.

- The giant monopolizes the track: represented by make-up, skin care and washing.For example, consumers of skin care products have good repurchase, relatively high loyalty, and can play a higher premium. The business matrix layout of strong players is quite mature, and their dominant position is consolidated through R&D and acquisition. New brands need to have the ability to break through single products, and the comprehensive requirements are relatively high.

We believe that online channels will seize the time dividend for new brands to resist international brand competition, and the update and evolution of e-commerce channels such as live broadcast will further penetrate the market demand. The logic of new domestic products representing good goods parity will continue for a long time, and the beauty care track is promising. We also look forward to the birth of more excellent new brands, platforms and service providers in various segments.

"Beauty is a form of genius, sometimes even higher than genius, because beauty needs no explanation." Man’s pursuit of beauty and self-satisfaction never stops.

Author: He Lixin Fu Yazhang Tang Xiaoxu; Wechat WeChat official account: Huaying Capital (ID: Meridian Capital)

This article comes from cooperative media @ Huaying Capital, where everyone is a product manager, by @ He Lixin, Fu Yazhang and Tang Xiaoxu.

The title map comes from Unsplash and is based on CC0 protocol.